A big part of our financial independence plan includes purchasing homes that we will rehab and then rent out. We refinance them to pull out cash so that we can do it again. Crunching the numbers before diving in helps to ensure that we are adding the right properties to our portfolio.

We have built in equity in the home and allocate a buffer for vacancies.

Right now Josh is still working full time, therefore we are not relying on the income from these properties.

The goal is to have a property that cash flows at least $300 after PITI and all expenses.

How We Calculate

Over the past year we have found that we do many of the same calculations over and over again.

It became obvious that creating a spreadsheet would be useful to quickly input our rough numbers and then see if the property would work for us.

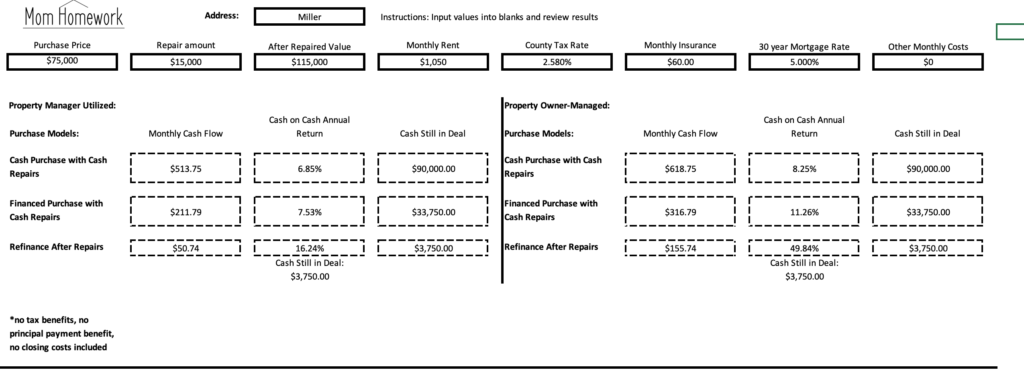

This is the form we have come up with!

As you can see there are a few key factors that are required for the calculations.

One thing that I find important to note is that sometimes refinancing a property for the full appraisal value will create a situation generating very little cash flow. In this case you either need to increase rent, or decrease the mortgage… or pass on the home completely.

There are two ways we calculate a deal:

1. Cash Flow

2. Cash on Cash Annual Return

A house can have great COC and low cash flow. The decision to maximize one or the other comes down to personal preference and where you are in your financial journey.

More than one way…

We use this as a jumping off point… just because a house appraises for a certain amount doesn’t mean it’s in our best interest to pull all that cash out in the interest of cash flow.

Or maybe for certain houses we DO want to pull out more cash and now we can see exactly where that will land us, how nice would it be to generate monthly income on a property where you have no cash in the deal?? That’s the goal of a great BRRRR.

In the case of the Miller house we had originally allocated around $1500-$3000 for new gutters and some minor work.

As you can see our estimated repair expenses were off: the house needed full HVAC system replacement, duct work repairs & hot water heater replacement. We elected to add AC, and are up to nearly $15,000 after this last round of plumbing repairs.

YIKES.

That’s the most that I’ve blown the initial budget. While the numbers can still work, and the house absolutely needed those repairs, we will see how things go. This may be a property that is better for us to exchange down the line for one that has a better cash flow.

You can visit here to check out how the final numbers came together for the Miller house after our appraisal.

Want your own copy of the spreadsheet?

Please visit here for the download.

Have fun playing around with the sheet and crunching those numbers!! The bold boxes across the top are where you input your information for the property.

Good luck deal hunting!

Can’t wait to try this spreadsheet out!

Can you please share your calculation spreadsheet? Thank you!!

Hello!! I am working on fixing the broken link on this page- if you navigate to “resources” in the meantime it should be the second download option. Thanks for bearing with me! I’m in the process of launching the new site 🙂

Can’t wait to try out the Sheet!

Thanks so much for stopping by! I’m working on fixing the link, you can find the spreadsheet in the “resources” tab for now!